All Categories

Featured

Table of Contents

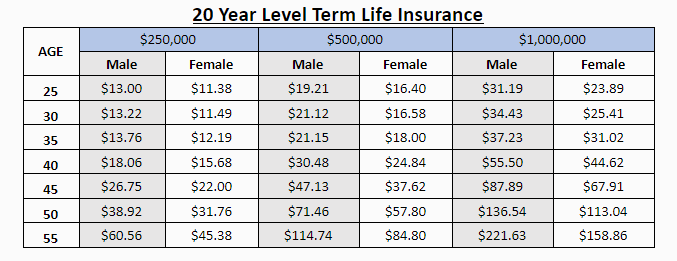

If you pick degree term life insurance policy, you can spending plan for your costs due to the fact that they'll stay the same throughout your term (Best value level term life insurance). And also, you'll understand precisely how much of a death benefit your beneficiaries will certainly get if you die, as this amount won't change either. The rates for degree term life insurance policy will certainly depend on numerous elements, like your age, wellness standing, and the insurance coverage business you pick

As soon as you go through the application and medical examination, the life insurance policy firm will certainly examine your application. They need to educate you of whether you have actually been accepted quickly after you use. Upon authorization, you can pay your very first premium and sign any pertinent paperwork to guarantee you're covered. From there, you'll pay your premiums on a regular monthly or annual basis.

You can select a 10, 20, or 30 year term and appreciate the included tranquility of mind you should have. Functioning with an agent can aid you locate a policy that functions finest for your requirements.

This is despite whether the insured individual passes away on the day the policy starts or the day prior to the policy finishes. In other words, the amount of cover is 'level'. Legal & General Life Insurance Policy is an instance of a level term life insurance policy plan. A level term life insurance policy policy can fit a vast array of conditions and needs.

What happens if I don’t have Guaranteed Level Term Life Insurance?

Your life insurance policy plan could additionally create component of your estate, so might be subject to Estate tax learnt more concerning life insurance policy and tax. Allow's take a look at some attributes of Life Insurance from Legal & General: Minimum age 18 Optimum age 77 (Life Insurance Coverage), or 67 (with Important Health Problem Cover).

The quantity you pay stays the exact same, yet the level of cover reduces about in line with the method a settlement mortgage reduces. Lowering life insurance policy can help your loved ones remain in the family members home and avoid any type of additional interruption if you were to pass away.

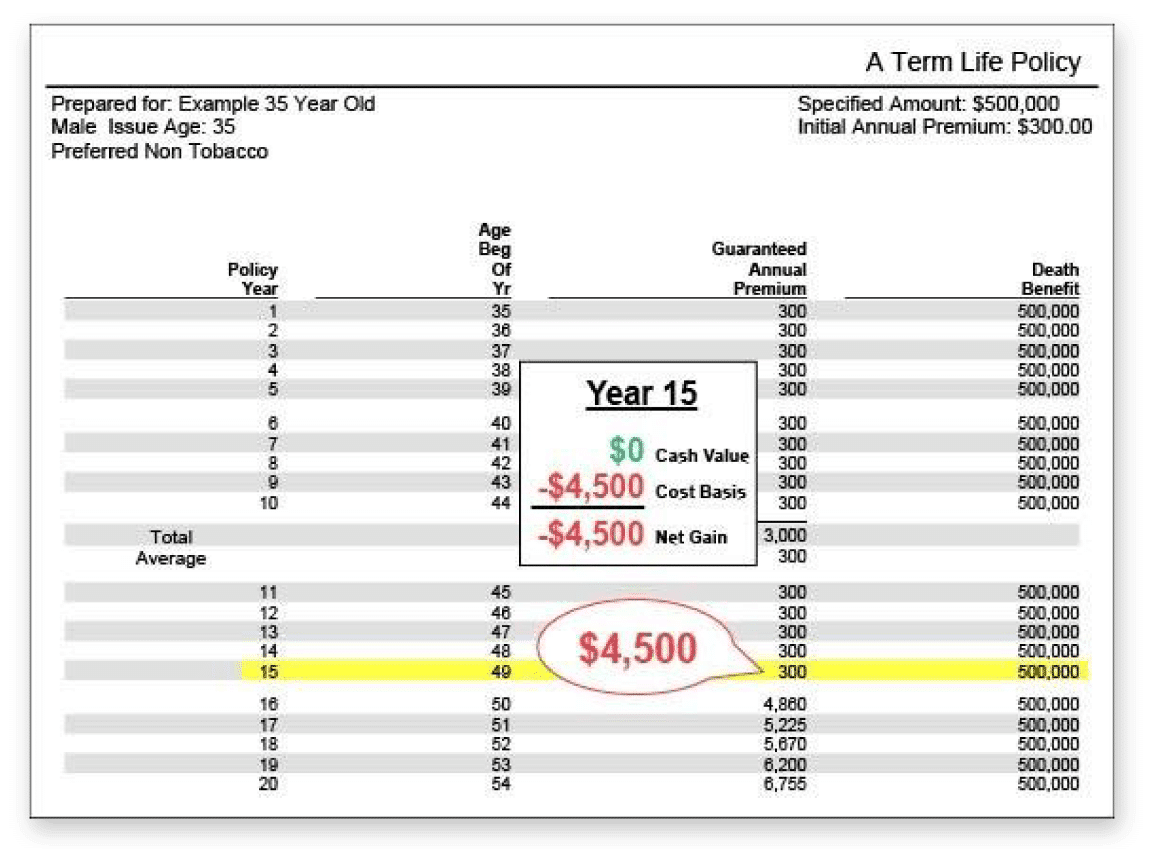

Term life insurance policy provides insurance coverage for a specific amount of time, or "term" of years. If the guaranteed person dies within the "term" of the plan and the policy is still effective (energetic), after that the death advantage is paid to the recipient. This kind of insurance normally allows clients to originally acquire more insurance policy coverage for less money (costs) than various other type of life insurance coverage.

Who offers flexible Level Term Life Insurance For Seniors plans?

Life insurance policy acts as a replacement for revenue. The potential danger of shedding that earning power profits you'll need to fund your family members's greatest goals like buying a home, paying for your kids' education, decreasing debt, saving for retired life, etc.

Among the primary charms of term life insurance policy is that you can obtain even more coverage for less cash. Nevertheless, the coverage expires at the end of the policy's term. An additional means term plans vary from entire life or long-term insurance coverage is that they normally do not construct cash money worth with time.

The theory behind reducing the payment later on in life is that the insured expects having minimized protection demands. For instance, you (with any luck) will certainly owe less on your home mortgage and other financial debts at age 50 than you would certainly at age 30. Therefore, you could pick to pay a lower costs and lower the amount your recipient would receive, since they wouldn't have as much financial obligation to pay on your behalf.

Level Term Life Insurance Calculator

Our policies are developed to complete the spaces left by SGLI and VGLI plans. AAFMAA functions to comprehend and sustain your one-of-a-kind financial objectives at every stage of life, tailoring our solution to your one-of-a-kind circumstance. online or over the phone with among our military life insurance professionals at and discover more concerning your army and today.

Level-premium insurance is a kind of long-term or term life insurance policy where the premium remains the exact same over the policy's life. With this kind of coverage, costs are therefore assured to continue to be the exact same throughout the agreement. For an irreversible insurance plan like whole life, the amount of coverage given increases with time.

Term plans are also frequently level-premium, yet the overage amount will stay the exact same and not grow. The most typical terms are 10, 15, 20, and 30 years, based upon the needs of the policyholder. Level-premium insurance coverage is a kind of life insurance in which costs stay the exact same price throughout the term, while the quantity of coverage offered boosts.

For a term plan, this indicates for the length of the term (e.g. 20 or three decades); and for an irreversible plan, until the insured dies. Level-premium plans will typically cost even more up-front than annually-renewing life insurance coverage policies with regards to just one year at a time. However over the long run, level-premium payments are usually much more affordable.

How do I cancel Level Term Life Insurance?

They each look for a 30-year term with $1 million in protection. Jen acquires an assured level-premium plan at around $42 each month, with a 30-year horizon, for a total amount of $500 per year. However Beth numbers she might just need a plan for three-to-five years or up until full payment of her existing debts.

In year 1, she pays $240 per year, 1 and about $500 by year five. In years 2 with five, Jen proceeds to pay $500 each month, and Beth has actually paid an average of simply $357 each year for the exact same $1 countless protection. If Beth no longer needs life insurance policy at year five, she will certainly have saved a lot of money family member to what Jen paid.

Annually as Beth grows older, she encounters ever-higher annual premiums. Jen will continue to pay $500 per year. Life insurance providers are able to offer level-premium policies by basically "over-charging" for the earlier years of the policy, accumulating even more than what is required actuarially to cover the risk of the insured passing away during that very early period.

2 Cost of insurance policy prices are established using methodologies that vary by firm. It's important to look at all variables when examining the total competition of rates and the value of life insurance policy coverage.

Is Level Term Life Insurance For Families worth it?

Like a lot of group insurance policies, insurance coverage plans supplied by MetLife consist of specific exemptions, exemptions, waiting periods, reductions, restrictions and terms for maintaining them in force. Please call your advantages manager or MetLife for prices and full details.

Table of Contents

Latest Posts

Funeral Expenses Benefit

Senior Final Expense

Best Rated Burial Insurance

More

Latest Posts

Funeral Expenses Benefit

Senior Final Expense

Best Rated Burial Insurance